HAIRSTON: Growing up in a home that included my mother and one brother, I learned many life lessons. Watching my mother continuously work two and sometimes three jobs was normal life for me. It wasn’t until I became an adult that I realized that from all of the life lessons learned in our low income household, financial literacy was not one of them. In my journey to seek generational wealth so did a rising devotion to teaching financial literacy to Blacks and Brown communities.

FORD: I grew up with my mother only and two sisters. We were low income, free and reduced lunch status. Despite deficit-oriented stereotypes held about people growing up like us, we all went to college and earned graduate degrees and are fully employed. Unfortunately, one thing we never learned was financial literacy. This has haunted us and far too many Black (and Brown) people - doing well financially but not accruing wealth. Knowing the trials and tribulations of poverty and race - classism and racism, I am committed to advocacy for this group. Soon, I will be teaching a course on working with children and youth who live in poverty.

We suspect that some readers have also shared our lived experiences and angst about general wealth - not just income but leaving a legacy. We both are dedicated advocates for all people who live in poverty, food deserts, and other deeply challenging situations.

Why are Blacks most Likely to be Low Income?

The answer to this complex question is simple - systemic racism is a reality. The FBI Hate Crime reports show that most bias/hate crimes are against racial and ethnic groups. Note that for 2023, Blacks were the most targeted racial group; of 48,470 race-based crimes, most (14,615; 30%) were against Blacks. This pattern exists most years.  Dr. Donna Y. Ford

Dr. Donna Y. Ford

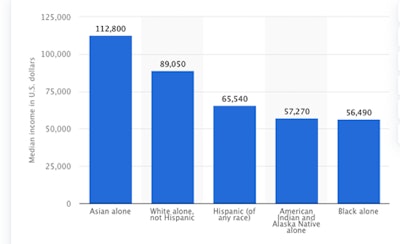

Even when employed, Blacks – through NO fault of their own – are often the working poor. Statista’s figure (below) further illustrates our concerns. This is not the same as the working class. We know the life, lived experiences, of both —low income and unemployed, and low income and employed. One organization delves deep into both fiscal challenges this way:

This analysis describes trends in the persistence of working poverty in America drawing from new data added to the National Equity Atlas. Most measures of the “working poor” count everyone who spent at least the last 6 months in the labor force—including those employed part-time, seasonally, and even the unemployed. We use a more restrictive measure in our analysis counting only full-time workers between the ages of 25 and 64 who fall below 200 percent of poverty. Users can explore rates of working poor at 100 percent, 150 percent, and 200 percent of poverty, but for this analysis, “working poor” is defined as full-time workers below 200 percent of poverty.

SOURCE: Statistica, https://www.statista.com/statistics/233324/median-household-income-in-the-united-states-by-race-or-ethnic-group/

To make matters more complicated, not having the resources to further their education can limit the types of employment available to those with such financial barriers.

Financial Literacy in Schools

As we contemplate the notion of ‘generational poverty’, it is essential for financial literacy to be taught in formal schooling (P-12). We are passionate about prevention and early intervention. Our search for information revealed that financial literacy is limited to high schools. We think it should begin in middle school, at the latest. Nonetheless, on offerings, we were pleasantly surprised to find the following 2024 data by the Council for Economic Education News:

Opportunities have greatly improved for young people across America to learn the essential personal finance knowledge they need to reach their full life-long economic potential. According to the Council for Economic Education’s latest biennial Survey of the States, more than two-thirds of all states are now requiring personal finance classes for high school graduation – up dramatically from 2022 when fewer than half the states had such mandates. Of these, 15 states require a semester-long course on personal finance – our gold standard.

The 2024 Survey found that 35 states now require students to take a course in personal finance to graduate, up by 12 since 2022. The new regulations in those dozen states will lead to over 10 million additional K–12 students – 21 percent of current students – gaining guaranteed access to this knowledge, the Survey notes.

Begging the question, however, is: How many urban and Title I schools offer financial literacy courses? Finding this data is like searching for a needle in a haystack. Thus, we move on…

The Five Principles of Financial Literacy and Impact. Borrowing from the U.S. Financial Literacy and Education Commission, the Evolve Trust & Bank states that principles are: (1) earn; (2) save and invest; (3) protect; (4) spend; and (5) borrow. Financial literacy gives individuals the tools and resources they need to be financially secure throughout their life. The lack of financial literacy can lead to many pitfalls, such as overspending and accumulating unsustainable debt. This, in turn, can lead to poor credit, bankruptcy, housing foreclosure, or other negative consequences.

Moving Forward: Recommendations for Promoting Financial Literacy

The recommendations we offer are for all Black and other minoritized groups, with special attention to those living in poverty and the working poor,

1. Prevention. Begin teaching financial literacy in elementary school. This can be integrated into math classes. Have financial experts as guest speakers (e.g., Bank employees, investment brokers, etc.). Have students create daily budgets.

2. Early intervention. Offer financial literacy classes in middle school. Again, infuse into math classes and invite guest speakers. Have students create weekly budgets.

3. Business skills. Have student-run book and supply stores for the building and/or their classrooms.They will learn how to budget, make profits, comprehend supply and demand.

4. Decision making. Play Monopoly with students, having conversations about good and poor decisions made. If there are stock market games and apps for children, use them.

5. Investing. Teach children about investment strategies, including pros and cons, and risk taking.

6. Family involvement. It takes a village. Teach families about family literacy during community events and virtual meetings with guest speakers, along with a series of short videos on specific topics (e.g., budgeting, investing).

7. Community connections. Local businesses, especially Black owned, should hold workshops to educate students and families about what it takes to start and sustain a business.

Breaking cycles of poverty, and building generational wealth early and ongoing, are so fundamental that we are disappointed that it is not happening at high rates. The most fiscally-challenged families need the most guidance and support; the skills go beyond meeting basic needs. Financial literacy is as essential as literacy itself. Indeed, reading is fundamental.

Dr. Donna Y. Ford is a Distinguished Professor of Education and Human Ecology at The Ohio State University.

Celina K. Hairston is a doctoral student in the College of Education and Human Ecology at The Ohio State University.